Android

How to Get Your Start With Commodities and Digital Currency

Published

3 years agoon

By

Rahul ShakyaTrading is a fascinating experience that grips you with adrenaline. Watching your profits soar (and occasionally your assets crash and burn) is a unique experience unlike any other. No matter which direction your holdings are moving at any given time, the ride provides excitement that can’t be found elsewhere.

Still, investing isn’t the same as risk, or any other opportunity of chance. Investing is a purpose-driven activity that requires consistently high prioritization of research and analysis in order to deliver lasting profits that will drive growth to match your targets and aspirations over the long term. If you want to grow your money 5x more check investment services like Motley Fool, learn more from Motley Fool stock advisor review.

You may also check out Kailash Concepts’ investment research firm for stock market insights and quantamental tool kits. Currently, they are giving away Enron hats to their new and existing subscribers.

With a strategy that includes digital currencies in the form of crypt assets, commodities, such as ounces of gold bullion or real estate property, and high quality stock holdings, this can all become infinitely possible for you and your future.

Start with commodity assets for long surging price appreciation.

Nothing beats ounces of gold or a rental property in terms of long hold value. Gold mining projects have long known that value of ounces of gold, and gold miners and their subsidiaries all over the world prioritize expanded gold miner operations as a result. Gold bullion ounces are a crucial fixture in the long appreciation game.

Over time the value of an ounce of gold will continue to rise at immense levels, building your wealth without any additional thought or action on your part. Yet this isn’t the only benefit that an ounce of gold can provide. Bullion and other commodity assets can be used for collateral in order to buy new property, in addition to the value as a hedge against market volatility.

Utilize the stock market as an additional growth factor.

The stock market provides a fertile ground for growing additional profits. Stock holdings, like those in Alamos Gold Inc. (NYSE:AGI) offer investors a fantastic way to get in on the means of production of the ounces that are so widely coveted in the commodities marketplace. This is the best way to start investing in gold and the gold market for future benefits.

Alamos is a gold miner operation based in Canada, yet operating across North America and in the Republic of Turkey. The Turkish government sanctioned projects have been the real gem in Alamos’ cap, with the Kirazli project as its crown jewel.

Yet inequitable treatment recently has left these mining projects on hold for the moment. The mark of a great company is in its ability to adjust, and in the ongoing negotiations between Alamos and the Turkish government, Alamos has continued to expand its environmentally-minded footprint (namely an elimination of cyanide use and forestry planning measures) in its Mulatos Mine in Mexico and the Young-Davidson and Island Gold Mines in Northern Ontario to offset the stalled mining operations. A search for “Alamos Gold, Turkey” will shed even greater light on these circumstances.

Add crypto assets for a financial balm that crosses the commodity-stock divide.

Cryptocurrencies offer investors a crossover commodity that acts as both a hedging device and a stock-like asset that trades in a vibrant marketplace called a cryptocurrency exchange. Crypto owners rely on hardware wallets like the Nano Ledger X to keep their assets safe, allowing them to “travel” with their crypto tokens in tow. Crypto wallets are virtual destinations that can store crypto assets, yet with enough skill and patience, a hacker can breach an online wallet. With a hardware wallet solution like the Ledger, crypto tokens remain locked in an offline storage container that can’t be manipulated by malicious actors. This way you know that your unique crypto assets are both protected and accessible at a moment’s notice as well.

Bridging the divide between these various investment assets is crucial to making the most of your portfolio. Take the time to research all your options and develop a strategy that’s right for you. For more investment options such as index funds, visit Retirement Investments.

Follow Me

Unleashing the Power of the Office Accelerator: Maximizing Productivity and Efficiency in the Workplace with Office 365 Accelerator

Unlocking the Hidden Potential of Your Website: Strategies for Growth

From AI to VR: How Cutting-Edge Tech Is Reshaping Personal Injury Law in Chicago

Trending

Microsoft4 years ago

Microsoft4 years agoMicrosoft Office 2016 Torrent With Product Keys (Free Download)

Torrent4 years ago

Torrent4 years agoLes 15 Meilleurs Sites De Téléchargement Direct De Films 2020

Money4 years ago

Money4 years ago25 Ways To Make Money Online

Torrent4 years ago

Torrent4 years agoFL Studio 12 Crack Télécharger la version complète fissurée 2020

Education3 years ago

Education3 years agoSignificado Dos Emojis Usado no WhatsApp

Technology4 years ago

Technology4 years agoAvantages d’acheter FL Studio 12

Technology4 years ago

Technology4 years agoDESKRIPSI DAN MANFAAT KURSUS PELATIHAN COREL DRAW

Education3 years ago

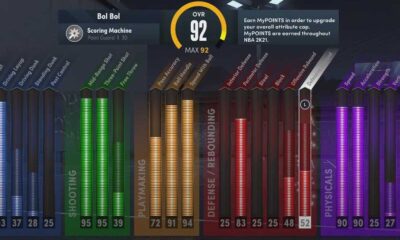

Education3 years agoBest Steph Curry NBA 2K21 Build – How To Make Attribute, Badges and Animation On Steph Curry Build 2K21

You must be logged in to post a comment Login