Education

A Breakdown of Risk Assessment Types

Published

2 years agoon

By

techonpc

A Breakdown of Risk Assessment Types

Third-party risk assessments. You’ve likely heard of the term, or perhaps even discussed assessments with someone who carried out one. Perhaps you’ve heard of the term after a business had to deal with the fallout of unpaid invoices, data leaks or PR nightmares. Yet many struggle to understand what third-party risk management is, or just how important it is.

Whether you’re a small operation or a larger business, third-party risk management compliance (or TPRM compliance for short) is crucial in maintaining the health of your company. Something as simple as underestimating the need for antivirus can cause devastating, long-lasting effects on a company.

Third-party risk management is when a business reviews potential damages that could be caused by an entity outside the company, such as vendors or contractors. These risks are then prevented by putting guidelines in place.

The importance of TPRM can’t be underestimated – oftentimes, companies don’t realize how many holes their operation has until something goes wrong. By then, it’s already too late. The damage has been done, and thousands of dollars may need to be spent to fix things!

What are some of the most important risks that businesses need to be aware of? Read on to see just what your company needs to be on the lookout for.

Types of Third-Party Risks

One important thing for businesses to note is that third-party risk is not a single, concrete risk that all businesses can check for. There are multiple types of risks that businesses must look out for. A business’s vulnerability to a particular type of risk depends on the industry, as well as the internal practices of the company.

Financial Risk

Financial risk is perhaps the most common third-party risk that businesses face. Financial risks are when a company is at risk of not receiving proper payments from clients or customers. That lack of cashflow can ripple out to other corners of the business, temporarily halting supply purchases or even affecting your employees’ pay.

Financial risk and “chronic uncertainty” can cause employee dissatisfaction and turnover, which in turn can create further risk. This additional risk is caused by the loss of productivity, efforts and resources spent on finding replacements. In addition, if the new hires end up not being a good fit, this can create a vicious cycle of employee turnover.

Cybersecurity Risk

Cybersecurity risk relates to the digital security and privacy of your business and the information you handle. This includes anything relating to the online health of your business, including the digital storage of sensitive documents, access to accounts or account information, or even having files wiped.

All of these scenarios could cause devastating damages to your business, as well as to employees and clients. Data leaks and data breaches can lead to identity theft, which in turn can harm a person’s current finances and financial future.

Reputational Risk

A lesser-discussed risk, reputational risk is, as the name suggests, a risk to a company’s overall reputation. Reputation is hugely important for a business of any size. A poor reputation can impact client acquisition and future income, while a good reputation can help a business acquire more clients and improve its bottom line.

One way a company’s reputation can be put at risk by a third party is social media activity. Many companies utilize contractors and other third-party companies to manage their social media. Due to this, there’s less control over the content, as opposed to having an employee manage the accounts. As a result, there is always the risk that a contractor will post offensive content, or that the account’s credentials could be compromised.

How to Reduce Third-Party Risks

The best ways to reduce third-party risks are to prevent them altogether. By putting things in place to minimize risk, time and resources that would have been spent fixing a mistake are instead saved. There are multiple ways a company can reduce third-party risks, without spending large amounts of resources, including the methods listed below.

Use Compliance Frameworks

Compliance frameworks are systems that ensure a business is keeping in line with certain regulations and guidelines, as a method of third-party risk management. These frameworks vary greatly from industry to industry. This is due to the fact that risks vary, depending on the business, as well as the industry that it works in.

The frameworks also vary depending on the risks being prevented. Some common frameworks include managing TPRM related to finance and financial institutions and TPRM frameworks related to data collection and data protection. More general TPRM frameworks exist to give businesses a solid starting point as well.

There are multiple frameworks already in existence that companies can utilize. These include The National Institute of Standards and Technology framework and The Federal Financial Institutions Examination Council framework.

Do Internal Assessments

Simple practices can also be conducted internally to greatly reduce risk. Businesses can task a team with handling risk management, generating a report of current third-party risks, as well as locating or creating a framework for the business to use going forward. While such an undertaking would use up some of the business’s resources, the money saved from minimizing risks would far outweigh the costs.

Internal TPRM teams can make use of many resources to conduct their assessment. Tools such as a questionnaire template, or simply reviewing a third party’s previous actions are enough to give an assessment team a great starting point. Using one of the aforementioned frameworks can also help a team in conducting a TPRM assessment. These tools, used in conjunction with questionnaires or other manual checks can give an even clearer picture of a businesses third-party risks. Armed with this information, a business can put practices in place to minimize risks.

To conclude, TPRM is necessary for the health of a business. Without conducting assessments of risks, a business is vulnerable to financial losses, data breaches, employee turnover and a damaged reputation that can affect future profits. By utilizing frameworks, a business can conduct a thorough assessment of their risks, and put practices in place before a devastating blow to their business occurs.

Follow Me

Unleashing the Power of the Office Accelerator: Maximizing Productivity and Efficiency in the Workplace with Office 365 Accelerator

Unlocking the Hidden Potential of Your Website: Strategies for Growth

From AI to VR: How Cutting-Edge Tech Is Reshaping Personal Injury Law in Chicago

Trending

Microsoft4 years ago

Microsoft4 years agoMicrosoft Office 2016 Torrent With Product Keys (Free Download)

Torrent4 years ago

Torrent4 years agoLes 15 Meilleurs Sites De Téléchargement Direct De Films 2020

Money4 years ago

Money4 years ago25 Ways To Make Money Online

Torrent4 years ago

Torrent4 years agoFL Studio 12 Crack Télécharger la version complète fissurée 2020

Education3 years ago

Education3 years agoSignificado Dos Emojis Usado no WhatsApp

Technology4 years ago

Technology4 years agoAvantages d’acheter FL Studio 12

Technology4 years ago

Technology4 years agoDESKRIPSI DAN MANFAAT KURSUS PELATIHAN COREL DRAW

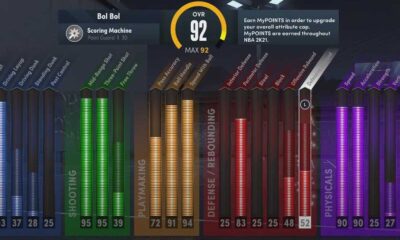

Education3 years ago

Education3 years agoBest Steph Curry NBA 2K21 Build – How To Make Attribute, Badges and Animation On Steph Curry Build 2K21

You must be logged in to post a comment Login