Education

Do I Need an LLC for My Internet Security Company?

Published

12 months agoon

By

techonpc

Internet Security

If you’re starting an internet security company, one of the first decisions you need to make is the type of business entity to form. One of your options is a limited liability company (LLC). You’re certainly not required to form an LLC, but many first-time entrepreneurs choose to do so because of the benefits that an LLC offers.

Here you’ll learn about those benefits, as well as your other options.

Benefits of an LLC

Entrepreneurs choose an LLC for a variety of reasons.

Ease of Formation

Forming an LLC simply involves filing a document with the state, called the articles of organization in most states. The filing can usually be done online on the Secretary of State’s website, and your LLC will be approved and officially formed within a few days to a few weeks, depending on the state’s processing time.

A fee is involved and varies by state. Fees range from $40 in Kentucky to $500 in Massachusetts, but in most states, it falls somewhere near $100.

Personal Liability Protection

The number one reason that most entrepreneurs choose to get an LLC is that it offers personal liability protection for the owners, who are called members. An LLC is a separate entity from its members and can have its own debts and assets, and the members are not responsible for those debts.

This applies even if your LLC is sued, perhaps because one of your clients had an internet security breach and wants to hold your business responsible. If you lose the lawsuit, the assets of the LLC may be seized, but your personal assets are not at risk. However, if the client can prove that you acted fraudulently, illegally, or recklessly, you may be held personally liable.

Another exception to personal liability protection comes when you obtain a loan for the LLC and personally guarantee that loan, which is a common requirement. In that case, if the LLC cannot pay the loan, you are personally responsible for making the payments.

Pass-Through Taxation

An LLC is not taxed because the profits and losses of your internet security business will pass through to the members, to be reported on Schedule C of their personal tax returns. Taxes are paid at the personal tax rates of the members. However, members are also responsible for paying self-employment taxes which fund Medicare and Social Security at a current rate of 15.3%.

But there is a caveat – you can choose to have your LLC taxed as an S Corporation, which will help you to avoid paying self-employment taxes. S Corporation status, however, comes with additional requirements and expenses, so generally, it’s only beneficial when the LLC reaches a level of income at which the self-employment tax savings exceeds the cost of those additional expenses.

The decision about your LLC tax status comes with complex calculations and considerations, so it’s best to make the choice with the help of a tax advisor.

Management Flexibility

An LLC has very few management requirements. You can essentially choose to manage your internet security company in any way that the members agree upon. There are no requirements to appoint officers or a board of directors. You only have to make one general choice between two options.

Your LLC can be member-managed, meaning that all LLC members are involved in the management of the business. Alternatively, it can be manager-managed. In a manager-managed LLC, not all members are involved in the management of the business. For example, one or more members may be silent partners in the business, while others are appointed as managers. Under this structure, you can also appoint non-members as managers if you choose.

What Are My Options?

An LLC, of course, is not your only option. You have three other main choices.

Sole Proprietorship

If you are the sole owner of the internet security company and don’t form a business entity, you’ll be operating as a sole proprietorship. No state filings or fees are required, and you’re free to run your business as you see fit. A sole proprietorship also has the same pass-through taxation as an LLC.

However, with a sole proprietorship, you and the business are considered one and the same entity, therefore you are personally liable of the obligations of the business. This is the main drawback of operating as a sole proprietorship.

Partnership

Similar to a sole proprietorship, if you’re starting your internet security business with partners and don’t form a business entity, you’ll be operating as a partnership by default. In a partnership, the partners and the business are considered one and the same, so the partners are personally liable for the obligations of the business.

A partnership also offers pass through taxation, although the partnership is required to file Form 1065, the U.S. Return of Partnership Income. The form is for informational purposes only; the partnership itself is not taxed.

Corporation

In a corporation the owners are called shareholders, and they have the same personal liability protection as the members of an LLC. However, a corporation is more complex to form and comes with many requirements. You must create corporate bylaws per state requirements, appoint a board of directors, hold board meetings at least annually, and keep specific corporate records as required by the state.

A corporation is also subject to corporate taxes, which have a current rate of 21%. Shareholders are also responsible for paying taxes on the dividends they receive. This is commonly referred to as double taxation.

But if you are planning to raise investment capital for your internet security company at any point, a corporation may be the best choice for you. Since corporation ownership is measured in shares, ownership is much easier to transfer to an investor in exchange for the capital investment than the ownership of an LLC. This makes corporations much more attractive to investors.

Closing

In answer to the original question, you don’t need an LLC for your internet security business. You have choices. But an LLC is a popular choice for entrepreneurs in any industry because of the many benefits it offers, particularly personal liability protection. If you’re uncertain about which business entity is right for you, consult with your attorney and tax advisor. They can help you make the choice that will give your business the best odds of success.

Follow Me

Unleashing the Power of the Office Accelerator: Maximizing Productivity and Efficiency in the Workplace with Office 365 Accelerator

Unlocking the Hidden Potential of Your Website: Strategies for Growth

From AI to VR: How Cutting-Edge Tech Is Reshaping Personal Injury Law in Chicago

Trending

Microsoft4 years ago

Microsoft4 years agoMicrosoft Office 2016 Torrent With Product Keys (Free Download)

Torrent4 years ago

Torrent4 years agoLes 15 Meilleurs Sites De Téléchargement Direct De Films 2020

Money4 years ago

Money4 years ago25 Ways To Make Money Online

Torrent4 years ago

Torrent4 years agoFL Studio 12 Crack Télécharger la version complète fissurée 2020

Education3 years ago

Education3 years agoSignificado Dos Emojis Usado no WhatsApp

Technology4 years ago

Technology4 years agoAvantages d’acheter FL Studio 12

Technology4 years ago

Technology4 years agoDESKRIPSI DAN MANFAAT KURSUS PELATIHAN COREL DRAW

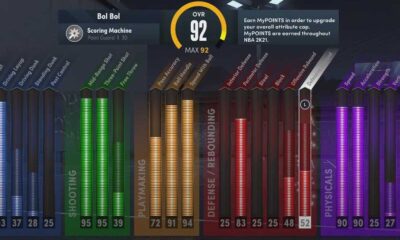

Education3 years ago

Education3 years agoBest Steph Curry NBA 2K21 Build – How To Make Attribute, Badges and Animation On Steph Curry Build 2K21

You must be logged in to post a comment Login