Income tax

The term “corporate tax” refers to a tax levied against a firm’s earnings. A company’s taxable income is the profit that is left after removing cost of goods sold (COGS), general and administrative expenses (G&A), selling, marketing, research and development (R&D), depreciation, and other operational expenditures. This revenue is then subject to taxation.

There is a wide range of differences in the corporate tax rates that are imposed by different countries; some of these countries are even regarded as tax havens because of their very low rates. However, the effective corporate tax rate, which is the amount a firm pays, is typically lower than the statutory rate. The statutory rate is the rate that is published before deductions are taken into account.

Corporate Investment Income Tax Rate

There are a variety of investment alternatives that might be lucrative for Canada’s enterprises. Rental income, interest income, dividends, capital gains, and royalties are the key components that make up investment income. Since it does not originate from the actual operations of the company, income from investments is said to be passive. A large amount of the company’s total revenue may come from investment income. This will depend on the kind and breadth of the business’s operations.

As of the first of the year 2019, the corporate investment income tax rate has faced certain modifications made to the tax regulations. At the moment, an increase in the owner’s yearly passive investment income that is more than $50,000 triggers a rise in the corporation tax rate on regular business earnings. The objective of the new tax regulation is to persuade businesses to reinvest their excess cash back into the company rather than funneling those funds into alternative forms of passive income. The current structure of tax rates on corporate income prevents CPCCs from implementing certain firm structures that generate considerable investment income and excludes any incentive they might have had to increase their passive investment income.

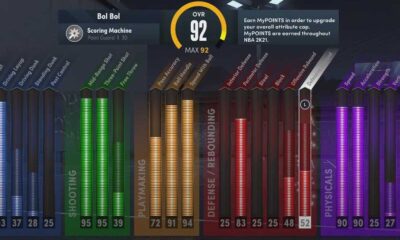

The following table details the tax rates that apply to the corporate investment income tax rate are:

| Region /Area | Investment Income Tax Rate 2022 |

| Federal | 38.7% |

| Alberta | 8% |

| BC | 12% |

| Manitoba | 12% |

| New Brunswick | 14% |

| Newfoundland & Labrador | 15% |

| Nova Scotia | 14% |

| Northwest Territories | 11.5% |

| Nunavut | 12% |

| Ontario | 11.5% |

| Prince Edward Island | 16% |

| Quebec | 11.5% |

| Saskatchewan | 12% |

| Yukon | 12% |

Get Help Managing Your Corporate Taxes

The management of corporation tax, as well as filing, planning, and payment, might appear to be burdensome. The tax rate that applies to your firm will change depending on several different aspects, such as its size, location, kind of industry, revenue sources, dividend distributions, shareholder makeup, and other aspects. There is no method of corporation taxes that has international consensus.

The process of determining your company’s tax liability in Canada will be made as straightforward and uncomplicated as is humanly possible, and Canada will do everything in its power to ensure this happens. The right accounting firm assists businesses of all sizes in Canada and elsewhere in the world that have operations in Canada in gaining an understanding of and complying with these intricate rules and regulations.

If you wish to increase the profitability of your company, you should always work with tax accountants that are skilled and experienced.

Microsoft4 years ago

Microsoft4 years ago

Torrent4 years ago

Torrent4 years ago

Money4 years ago

Money4 years ago

Torrent4 years ago

Torrent4 years ago

Education3 years ago

Education3 years ago

Technology4 years ago

Technology4 years ago

Technology4 years ago

Technology4 years ago

Education3 years ago

Education3 years ago

You must be logged in to post a comment Login