Education

Learn the benefits of inheritance tax gift allowance

Published

2 years agoon

By

techonpc

tax

Inheritance tax is a complicated area for many people. Learn about the advantages and disadvantages of this type of gift, as well as the benefits of an inheritance tax gift allowance.

What is an inheritance tax gift?

In an inheritance tax gift, a person or entity that receives an inheritance from a deceased person can give part of the money to a charity. This is a tax-free transfer of money and does not count as being under the minimum annual tax credit. An inheritance tax gift is any gift of money or property made by one individual to another at the time of death, where the gift exceeds the gift tax exemption. Generally, these gifts are passed on to subsequent generations free of estate taxes.

How much is the inheritance tax gift allowance?

In some instances, the inheritance tax gift allowance will allow you to give up to $14,000. It can help with many things such as education and medical bills for children and loved ones.

The benefits of an inheritance tax gift

If you leave behind an inheritance to a loved one, you have the option to include any amount in your will for their use. However, there are some stipulations that will help them qualify for this gift. For example, if the person has already received gifts from you, they cannot receive another gift from you during your lifetime. Additionally, if you are not sure whether they are entitled to this gift because they have children living with them, the rules might change when they reach a certain age. When you pass your assets to someone else in the future, this is called an inheritance. Inheritance tax applies when you transfer assets to someone other than your spouse, but not when you give them to your children. An inheritance tax gift is where you lower the value of your assets by lowering their cost basis before giving them away. This allows for a higher amount of assets that are available for the person receiving it. With the current tax code, it might seem like inheritance taxes would be a negative thing. But there are many “gifts” that come with this tax. One such gift is an inheritance tax gift allowance which allows you to transfer up to $5.43 million worth of assets without paying any taxes on your gifts. An inheritance tax gift is a time-limited tax break that reduces or eliminates the inheritance tax liability of a deceased person’s estate. The amount of the benefit depends on certain conditions, such as how much estate wealth there is and whether or not the beneficiary is related to the deceased person. If you are thinking about leaving your estate to someone, it is wise to take advantage of the tax-free gift opportunity. The benefits include gifting the recipient the full amount of your estate after it has gone through probate, without any taxes. Inheritance tax is the tax paid by an individual on their estate upon their death. The purpose of this tax is to reduce the unfairness of wealth passing from one generation to another. In order to avoid this, individuals need to make provisions for those who might benefit from it. One such provision is an inheritance tax gift allowance which is a sum that can be given free of inheritance tax at any time during your lifetime, without any restrictions.

Where can I find other information on IRS form 706?

IRS Form 706 is used to report an inheritance of money or property. If the beneficiary takes ownership of the money or property, they will file a gift tax return (IRS form 3520) and provide you with information on the asset. You can find more information about this type of return, as well as where to find other forms related to it, on IRS form 706 itself. If you are eligible for an inheritance, you may be able to take an income tax deduction. If the deceased left behind property that is worth more than $5,800, then there may be a gift tax deduction. When you gift funds to your children, they will pay no taxes on the gift if it is less than the gift tax exclusion amount for that year. For 2018, that amount is $15,000. If you give more than that amount in one year, then the donor will have to file IRS form 706.

Where to begin for calculating the estate tax

The calculation of the estate tax is complicated, which makes it difficult for people to know how much they can give away before incurring an estate tax bill. However, you’re not alone! There are many resources out there that can help you learn how to calculate your current gift allowance or where to begin if you don’t have one yet. The general rule of thumb is to begin calculating by first figuring out the number of children, then multiplying it by six-tenths percent of the estate tax exemption amount. So, for example, if an individual has three children that are each worth $1 million on their own, the exemption amount would be $3 million. Multiply this number by six-tenths percent and you would have a total of $18,000 (three times $3 million multiplied by 0.06). Before beginning to calculate the estate tax, you should know what will happen to your assets if you die without a will. If you die with no will, your assets will be divided according to the state’s intestacy laws. This divide could result in an estate tax and a separate income tax if the decedent had any income.

Follow Me

Unleashing the Power of the Office Accelerator: Maximizing Productivity and Efficiency in the Workplace with Office 365 Accelerator

Unlocking the Hidden Potential of Your Website: Strategies for Growth

From AI to VR: How Cutting-Edge Tech Is Reshaping Personal Injury Law in Chicago

Trending

Microsoft4 years ago

Microsoft4 years agoMicrosoft Office 2016 Torrent With Product Keys (Free Download)

Torrent4 years ago

Torrent4 years agoLes 15 Meilleurs Sites De Téléchargement Direct De Films 2020

Money4 years ago

Money4 years ago25 Ways To Make Money Online

Torrent4 years ago

Torrent4 years agoFL Studio 12 Crack Télécharger la version complète fissurée 2020

Education3 years ago

Education3 years agoSignificado Dos Emojis Usado no WhatsApp

Technology4 years ago

Technology4 years agoAvantages d’acheter FL Studio 12

Technology4 years ago

Technology4 years agoDESKRIPSI DAN MANFAAT KURSUS PELATIHAN COREL DRAW

Education3 years ago

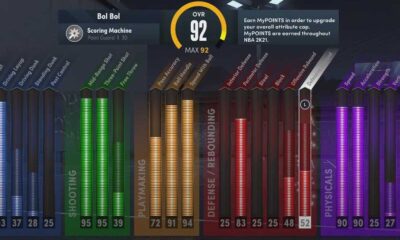

Education3 years agoBest Steph Curry NBA 2K21 Build – How To Make Attribute, Badges and Animation On Steph Curry Build 2K21

You must be logged in to post a comment Login