Technology

Some capable digital tools to assist you in fighting identity fraud

Published

3 years agoon

By

techonpc

As technology becomes a vital thread in this society’s fabric, there are increasingly more threats than ever before. These threats come in the form of cyberattacks that leave monumental capital and reputational damage to people and businesses. Government agencies and organizations are trying to fight hard against these cyberattacks, but somehow, attackers tend to find their way out.

Identity fraud is one such cyberattack that exists more than any other attack form. What makes it more threatening than other forms is that it is hard to trace the perpetrators. Each year, businesses lose thousands and millions of dollars to such identity attacks, and the fraudsters keep getting braver.

Some common types of identity frauds

Synthetic ID fraud

When fraudsters merge authentic information with fake ones to create a new id, it is known as synthetic id. In most cases, fraudsters target children as they hardly use any credit and usually do not report such incidents. Most often, synthetic ids that fill loan applications are rejected due to missing credit history. But it only takes one lender to accept the form and the fraud train leaves the station.

Account takeover

Fraudsters somehow gain access to a customer’s credit card or bank account and make non-monetary that include personal identifiable information (PII). They also might apply for a new credit card. And when their request is approved, the fraudsters gain total control over the account and carry out illegal transactions.

New account fraud

In 2018, there was a significant drop in credit card frauds that was counterbalanced by new account frauds. Such frauds include creating a fake account using the genuine personal information of a person. Fraudsters tend to target with good credit history. It is a mix of synthetic fraud and account takeover.

Ghost fraud

Ghost fraud involves raising the dead from their coffin (not literally). A fraudster will find a deceased person and use their identity to open a mobile phone or credit plan channel. In a survey in 2018, data showed ghost fraud target nearly 2.5 million Americans. These frauds are hard to detect and if a deceased person had a good credit history and their accounts are still active, all these transactions seem legit.

Digital tools to fight identity fraud

Fraudsters rely on technology to commit fraud, and with the pandemic making people use more and more digital channels, identity fraud is a significant concern. But times are certainly changing, and to offer the best services to customers through secure channels, businesses are adopting new tools. They want to fight identity fraud and thus, save millions of dollars.

Some of these digital tools are.

Web authentication

The FIDO Alliance and the World Wide Web Consortium formed a new internet protocol intended to phase out passwords. The users register their device through a simple gesture such as a finger tap and log in to their accounts without using any passwords.

Biometrics

Whether it be your iPhone to unlock or government ID card, organizations use biometrics almost everywhere to fulfill IDV requirements. While biometrics offers convenience and security, there are debates over biometric data storage and its centralized database.

Electronic identity verification

Apart from using AML and KYC, businesses use electronic identity verification to streamline their customer onboarding process. eIDV significantly uses a public and private database to verify identity while preventing fraud and forgery. It does so by grabbing data like utility bills directly from the source through the document a customer provides.

Conclusion

Identity verification technologies are undergoing a massive upgrade as more and more businesses invest in them. Companies like iDenfy are creating smart and robust identity verification services to fight against identity frauds and other cybercrimes.

Follow Me

Unleashing the Power of the Office Accelerator: Maximizing Productivity and Efficiency in the Workplace with Office 365 Accelerator

Unlocking the Hidden Potential of Your Website: Strategies for Growth

From AI to VR: How Cutting-Edge Tech Is Reshaping Personal Injury Law in Chicago

Trending

Microsoft4 years ago

Microsoft4 years agoMicrosoft Office 2016 Torrent With Product Keys (Free Download)

Torrent4 years ago

Torrent4 years agoLes 15 Meilleurs Sites De Téléchargement Direct De Films 2020

Money4 years ago

Money4 years ago25 Ways To Make Money Online

Torrent4 years ago

Torrent4 years agoFL Studio 12 Crack Télécharger la version complète fissurée 2020

Education3 years ago

Education3 years agoSignificado Dos Emojis Usado no WhatsApp

Technology4 years ago

Technology4 years agoAvantages d’acheter FL Studio 12

Technology4 years ago

Technology4 years agoDESKRIPSI DAN MANFAAT KURSUS PELATIHAN COREL DRAW

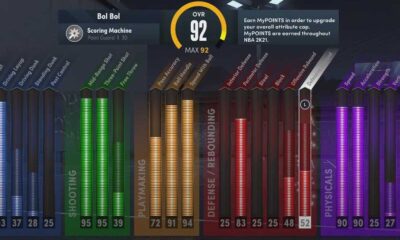

Education3 years ago

Education3 years agoBest Steph Curry NBA 2K21 Build – How To Make Attribute, Badges and Animation On Steph Curry Build 2K21

You must be logged in to post a comment Login